| Particulars | Amount (₹) |

|---|---|

| Purchase Price | - |

| Annual Annuity | - |

| Monthly Annuity | - |

What is LIC Jeevan Akshay plan ?

LIC Jeevan Akshay plan is a special plan for Immediate Annuity plan under which you can buy through lump sum payment as Single Premium. This plan has provides to the policyholder for annuity payments which are available throughout the life time of an annuitant.

These are the following provided options are available under the plan for the policy holder

A) Type of Annuity:

i) They are provided the regular annuity for life.

ii) These Annuity are payable for 5, 10, 15 or 20 years certain and thereafter as long as the

annuitant is alive.

iii) Annuity for life with return of purchase price on death of the annuitant.

iv) Annuity increasing at simple rate of 3% p.a.

v) Annuity for life with a provision of 50% of the annuity to spouse for life on death

of the annuitant.

vi) Annuity for life with a provision of 100% of the annuity to spouse for life on death

of the annuitant.

At give option You may choose any one. Once chosen, the option cannot be altered. this is locked processes.

B) Mode:

Under this plan policy holder can select the option of Annuity paid mode either at monthly, quarterly, half yearly or yearly intervals.

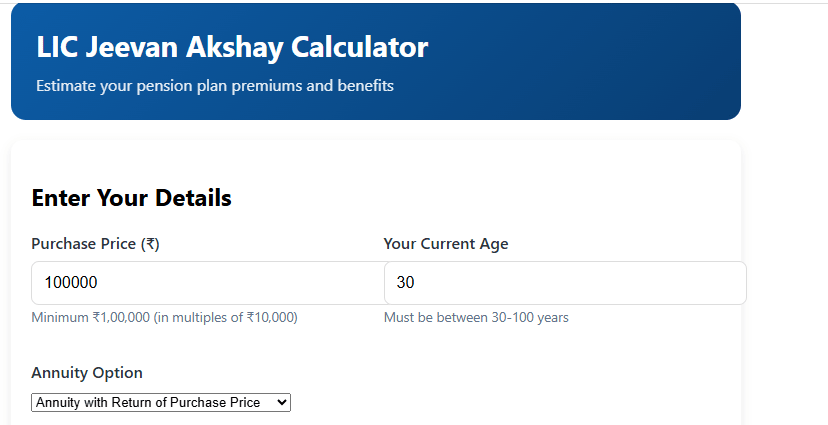

How to use LIC Jeevan Akshay calculator?

LIC Jeevan Akshay policy calculator is an a online calculator which are work very simply to calculate the Annual Annuity, Monthly Annuity benefits instantly or very quickly. you have to fill some required information like plan term, term age and select the Annuity option .here we see the how to use this calculator step by step.

Step 1: Enter Basic Details

These calculator has needed some basic detail for the calculation there for you have to enter Enter Basic Details as per the required calculator .

- Purchase Price :- this is the amount which are ant one want to invest. there for

- Enter the amount you want to invest (minimum ₹1,00,000)

- Example: For ₹5 lakhs, enter 500000

2. Your Age :- this section provided the option to fill the current age of policyholder . then

- Enter your current age (must be between 30-100 years)

- Example:

45years

Step 2: Select Annuity Options

Annuity Type

This is last option where you have to select any one of the listed below as per requirment.

- Life Annuity: Regular payments till death

- Return of Purchase Price: Payments + money back to nominee

- Joint Life: Continues for spouse after death

- Increasing Annuity: Payments rise 3% yearly

Payment Frequency :- this section provided the payment time line mode as you think ..

- Select how often you want payments:

- Yearly / Half-Yearly / Quarterly / Monthly

Step 3: Calculate

After fill the all information that you have to Click “Calculate Annuity” to see results. where we get the Purchase Price, Purchase Price and Annual Annuity instantly.

Real-Life Scenario: Using the LIC Jeevan Akshay Calculator

There are real life scenario of using LIC Jeevan Akshay calculator very easily with proper input and output data .

Meet Rajesh – A Retired Government Employee , which Age: 60 years

Investment Plan: Secure a regular pension for retirement

Step 1: Entering Details

Here Rajesh wants to invest ₹10 lakhs from his retirement savings into LIC Jeevan Akshay.here input are show below.

- Purchase Price: ₹10,00,000

- Age: 60 years

Step 2: Choosing Annuity Options

Rajesh considers his family’s needs and select the Annuity type option and listed what may be benefits of following option from 1 to 3 .

Annuity Type:

Option 1: Life Annuity (Highest Pension): If Rajesh select this option then get the following benefits in future.

- Gets ₹6,500/month (₹78,000/year) for life

- No money returned after death

Option 2: Annuity with Return of Purchase Price : Here if they select option 2 then they will get below give benfites.

- Gets ₹5,500/month (₹66,000/year)

- On death, ₹10 lakhs returned to nominee

Option 3: Joint Life with Spouse: this option are show that what Rajesh a policyholder get .

- Gets ₹5,000/month (₹60,000/year)

- After Rajesh’s death, spouse continues getting ₹2,500/month

Payment Mode:

Chooses Monthly for regular household expenses.

Step 3: Calculation & Decision :- this is calculation benefits getting from selection of this listed three Annuity option in tabular form.

| Option | Monthly Pension | Yearly Pension | Death Benefit |

|---|---|---|---|

| Life Annuity | ₹6,500 | ₹78,000 | None |

| Return of Capital | ₹5,500 | ₹66,000 | ₹10 lakhs to nominee |

| Joint Life | ₹5,000 | ₹60,000 | 50% pension continues to spouse |

Rajesh’s Decision:

He picks “Return of Purchase Price” because:

- He gets ₹5,500/month for expenses.

- His wife will receive ₹10 lakhs if he passes away early.

Key Formulas Used in LIC Jeevan Akshay Calculator

Dear, friends here we will get Key Formulas Used behind the LIC Jeevan Akshay Calculator. these are some basic information that you have to know .

- Basic Annuity Calculation

The primary formula calculates the annual annuity payout based on these two given below options.

- Purchase Price (PP): this is an Lump sum invested (e.g., ₹10 lakhs).

- Annuity Rate (AR): This is percentage determined by LIC, which may be get varying by age, gender, and annuity option.

LIC Jeevan Akshay Formula:

Annual Annuity=Purchase Price × Annuity Rate

Example:

There is an example for a 60-year-old has investing ₹10 lakhs in Option A (Life Annuity) with an annuity rate of 9.265% (Feb 2024 rates). then Annual Annuity of this input is get ₹92,650 per year which are calculated by using the above formula. the mathematical calculation of of using formula is shown below.

₹10,00,000×9.265%=₹92,650 per year (₹7,721 monthly)

LIC Jeevan Akshay plan detail

| Feature | Details |

|---|---|

| Plan Type | Immediate Annuity Plan |

| Eligibility – Entry Age | 30 years to 85 years |

| Premium Payment | One-time lump sum (Single Premium) |

| Annuity Options | 10 different annuity options (Life Annuity, Return of Purchase Price, Joint Life, etc.) |

| Minimum Purchase Price | ₹1,00,000 (offline) / ₹1,50,000 (online) |

| Maximum Purchase Price | No limit |

| Minimum Annuity | ₹12,000 per annum |

| Payment Modes | Monthly, Quarterly, Half-Yearly, Yearly |

| Loan Facility | Available (after 3 months) |

| Surrender Value | Available under certain annuity options |

| Death Benefit | Depends on annuity option chosen (e.g., return of capital to nominee) |

| Tax Benefit | Premium eligible under Sec 80C, Pension taxable under Sec 80CCC/80D |

What is LIC Jeevan Akshay plan ?

LIC Jeevan Akshay plan is a specil plan for Immediate Annuity plan under which you can buy through lump sum payment as Single Premium. This plan has provides to the policyholder for annuity payments which are available throughout the life time of an annuitant.

What are the benefits of lic jeevan akshay?

Here are many benefits of lic jeevan akshay given below.

1. If under this plan once you invest a lump sum, then this policy of LIC has guarantees a fixed pension for life. This ensures financial security during retirement.

2. The lic jeevan akshay plan offers many different annuity choices such as life annuity, return of purchase price, joint life, increasing annuity, etc.

3. this is a best benefit where After 3 months of policy purchase policy holder , can avail a loan against the policy under specific annuity options.

4.under this plan of lic premium paid is eligible for tax deduction under Section 80C, while the pension income is taxable as per your income tax slab.

What are the disadvantages of Jeevan Akshay?

Once you buy the plan by paying the lump sum, you cannot withdraw or stop it (except under specific surrender conditions). Your money gets locked.